Checkout and much more

Since the posts didn’t come from you, our very own hands is tied so we recommend contacting the new merchant myself. I as well as highly recommend calling the fresh merchant for many who don’t remember deciding to make the pick and want more information. This service membership supplier tend to deal with all of the refund desires, therefore consider the website or let them have a trip. If they don’t function or if you’re let down with their effect, call us to your 1913 so we’ll create our very own far better assist you. For many functions, merely find 3Pay otherwise 3Billing and you may follow the recommendations. You’ll rating an excellent PIN provided for you from the text message to ensure you buy.

Funding You to bank card security features – have a peek at the hyperlink

A zero-costs EMI otherwise no percent EMI is a deal that allows one purchase a product inside the reasonable month-to-month costs having no interest. In simple terms, it indicates that you’re simply make payment on total price away from the product or services inside EMIs with no a lot more charges. Such, if you buy a smart device value ₹ 21,100000 in the step three-few days no cost EMI, you’re going to have to spend ₹ 7,100000 monthly for another 90 days.

Prefer Pay by the Cell phone as your Payment Choice

Which have remote deals, it can be hard to make sure you happen to be giving out such sensitive and painful information for the meant seller rather than to help you a good fraudster. And you may defenses which could if you don’t stop it exposure will not be from far include in an above-the-cellular phone purchase. This is what understand to help you curb your susceptibility to help you fraud whenever and make repayments in that way.

Dash cellular software

Select £ten, £25, £40, £fifty, £75, £100, £125, £150 otherwise £175. After you’ve your own credit, electronic otherwise actual, make use of it to spend on line by going into the unique 16-thumb password when caused. There aren’t any more charge for using the paysafecard therefore may use your own card to have several requests. Paysafecard is a prevalent on line percentage strategy by highest amount of defense and confidentiality it provides to help you their profiles. Based in the Austria inside 2000, it’s now for sale in more than fifty places global. While the an installment approach, it’s very user friendly since it doesn’t require a bank account or credit card.

With the services, your genuine cards matter isn’t even provided to the merchant when you make a purchase. Instead of the credit card amount, it discover a safe fee token linked with the brand new affirmed credit. For individuals who’ve already got a woeful credit record, this could signal you of getting the most recent and most expensive mobile phones, such as the iphone 3gs 15. The new brand-new cell phones come with costly payment per month arrangements, so that your first solution is to get a less costly, old cellular telephone. After you create a mobile phone package, you always must solution a credit score assessment.

Along with, possibly the modern mobile phones must be recharged more frequently than simply faithful card subscribers. Stripe and you may Adyen is each other designed for designers and large organizations wanting to put Tap to invest features into their individual application. We thus don’t suggest they to possess private entrepreneurs otherwise smaller businesses that simply only need to undertake contactless costs. Generally, the fresh smartphone – such as EFTPOS servers – transfers deal research in order to a fees chip over the telephone’s net connection. Whenever authorised because of the related financial institutions, card providers or other mediators, the transaction is done. Other NFC companies mostly inside the European countries fool around with contactless payment more than mobile devices to cover to the- and you can of-street vehicle parking inside the particularly demarcated parts.

We’d recommend they to possess smaller businesses and you will startups one obtained’t always require extra features. Yet not, the fresh faucet and you will processor credit reader will probably be worth the extra currency whatever the sized your online business. We’ve seemed the market industry and you may examined those team to locate the five better credit card customers to possess iPhones. Those days are gone from carrying cash if you don’t swiping a great card to make a purchase. Inside today’s electronic-basic community, contactless cellular phone payments has revolutionised just how someone shop.

There is plenty of casinos you to definitely undertake pay by cellular phone bill here. In this publication we will have a peek at the hyperlink give an explanation for great things about having fun with a good shell out from the mobile phone expenses casino and you may things to search aside to possess whenever choosing you to. There aren’t any more charge for using the portable in order to shell out, however you will need to enter into your own card’s PIN in the EFTPOS machine to your transactions a lot more than $one hundred. The most popular mobile phone-based card viewer, Rectangular Viewer, can be found to possess $65 incl. It offers no contractual lock-inside the otherwise fee every month, only a pay-as-you-wade deal rates of 1.9%. Even though Square gives the really functional, user-amicable have, the transaction price of 1.9% for Charge, Mastercard, eftpos and Amex cards is not necessarily the reduced.

The best way to explore Apple Card is with Fruit Pay — the new secure percentage technical built-into new iphone 4, Apple Check out, ipad, and you may Mac and you may acknowledged during the 85 per cent out of merchants in the usa. Apple Spend is actually a safer way to pay that helps your avoid touching buttons otherwise investing bucks. With all of the pick you make with your Fruit Cards which have Fruit Shell out, you earn dos% Daily Money back. Merely real money you could potentially invest, posting, otherwise save and build more day.

Payments is associated with the cellular phone.If your cellular telephone is forgotten otherwise taken — if not should your electric battery passes away — you’re from chance, as you cannot build costs. Apple Spend is among the most widely accepted kind of electronic percentage, however, simply 36% from North american stores back it up. In addition to, remember that the newest Amex Application allows you to safer your account which have a good fingerprint otherwise FaceID login, and make use of the software in order to freeze your own cards immediately if this’s destroyed otherwise taken.

It supports additional team apps but is expensive for companies that aren’t already and then make a lot of money. That is you to ability that could only be it is counted as a result of the reviews from other business owners by using the fee control services. The fresh mini-package try followed closely by a tight, fully-searched equipment.

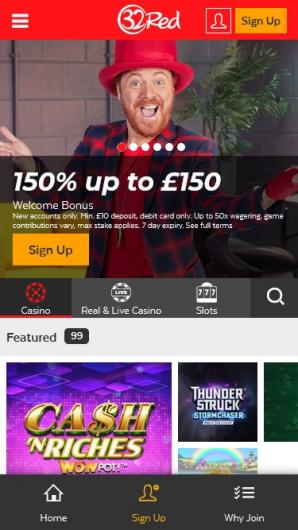

As expected, the fresh deposit restrictions try lower than questioned, making this perhaps not a high choice roller to be delighted having. It is good for all who would like to wager now and shell out later and those who desire to remain its betting in balance. While not all of the bookies try telephone bookmakers, the count is rising. Placing along with your cellular telephone statement is as easy as deciding on the fee solution in the Repayments webpage. Simultaneously, you will then manage to claim some other put or no put offer in the a gaming web site one to welcomes cellular telephone bill deposits.

The fresh strategies and you will handling make it virtually impractical to get it done. How would one be added to your cellular phone statement without causing the newest cellular network supplier issues? Generally, they’d are obligated to pay your $one thousand, and this must be resolved possibly by credits or from the wiping your cell phone expenses to your foreseeable future. It’s offered at the of many British, Canadian, Australian, and you may The brand new Zealand gambling enterprises, and on the Eu. Various other percentage procedures are not always universally readily available.

We feel individuals should be able to make financial behavior which have rely on. Write to us how good the content in this article repaired your condition today. All the views, self-confident otherwise bad, helps us to change exactly how we let small businesses. Payline Investigation (come across our very own remark) once again provides retail, e-business, and cellular options, plus it claims to supply the low cost, protected. They’ll also give you $five hundred if they can’t defeat your prices.

Below are a few such amazing sale to the the fresh mobile phones, for instance the new iphone 13 plus the Samsung S22. The newest concerns made to your credit report after you expose a great new product otherwise financing a cell phone could affect your borrowing from the bank. Credit issues is actually ten% of your credit rating and apply at your borrowing from the bank to own 12 months.

And with our very own versatile arrangements and you can funds selling, we’ve had a phone for all. Cellular telephone security functions in a similar way for other insurance points you can also have, such as automobile insurance. If your product is busted through the a secure knowledge, you can file a state.